You're Making a Difference

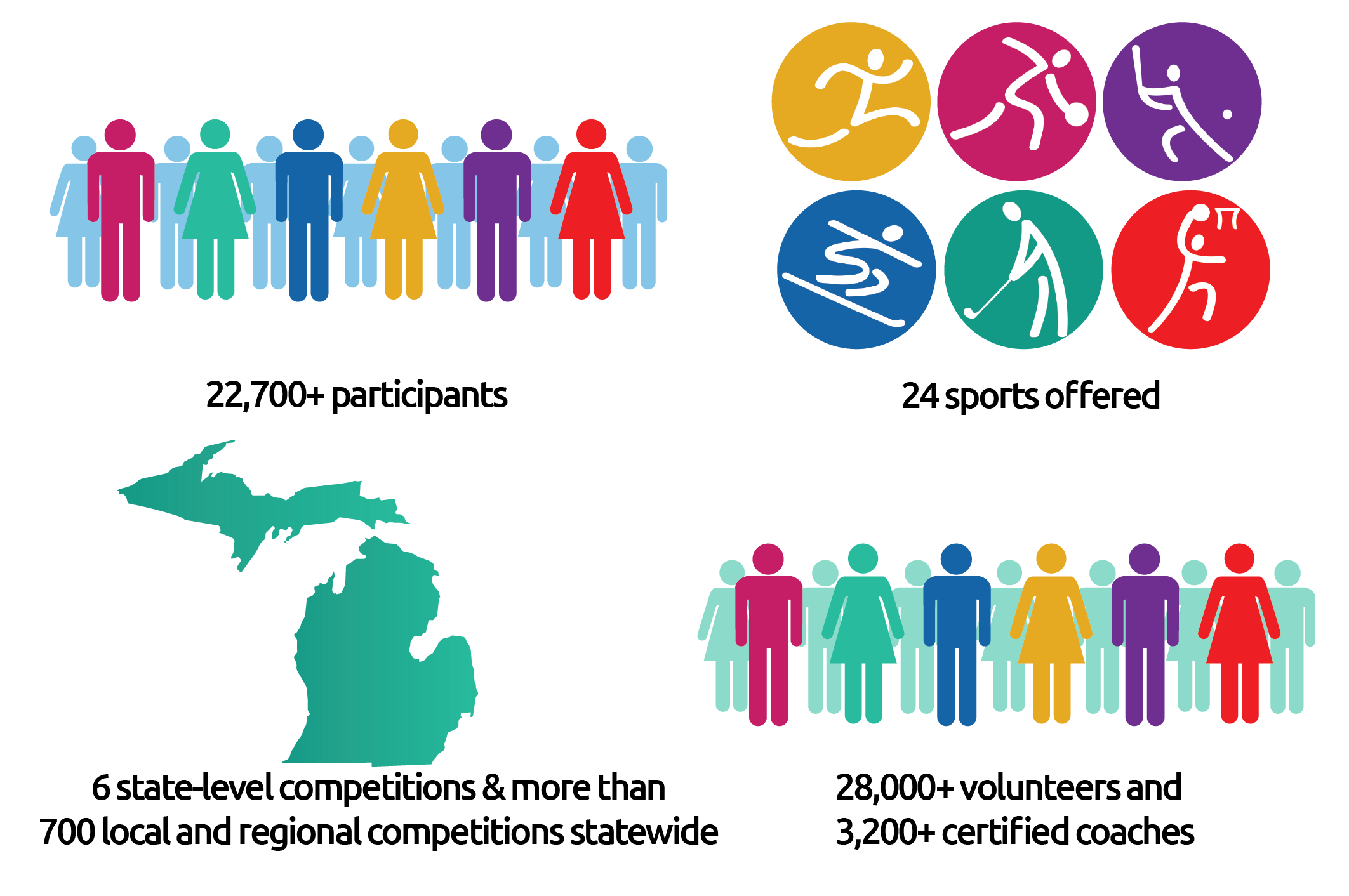

Because of generous contributions like yours, Special Olympics Michigan is able to serve over 22,000 participants by offering 24 sports and facilitating over 700 local, regional, and statewide competitions every year. But Special Olympics Michigan is so much more than a sports program -- your donation helps provide seven Health and Wellness programs, Young Athletes programs, and Unified school and sports programs throughout the state of Michigan.

Gifts can be given to Special Olympics Michigan in a variety of ways. Take a look at the options below, and contact us to discuss the best giving options for you. Together we can ensure the athletes of Special Olympics Michigan continue to grow in confidence and joy.

Give Now or Later

Donate by Mail

Wish to donate by mail? Make your check payable to Special Olympics Michigan and send it to us at:

Special Olympics Michigan

Central Michigan University

Mt. Pleasant, MI 48859

Special Olympics Michigan

160 68th Street SW

Grand Rapids, MI 49548

Special Olympics Michigan

1150 Scott Lake Road, Suite 3a

Waterford, MI 48328

Support a Signature Event

Our Signature Events gather supporters and friends of Special Olympics Michigan to celebrate the Inclusion Revolution while raising critical funds for our Athletes. Join us as an attendee, sponsor, or supporter of our annual signature events taking place in Detroit and Grand Rapids.

Give Later

Planned gifts allow a lasting legacy and continued support for Special Olympics Michigan. Learn more about how you can plan for the future.

Stocks, Bonds & Mutual Funds

Receive a deduction for the full fair market value and avoid paying tax on your capital gain. This giving option can provide greater tax benefit than a cash gift of the same amount.

Impact in Action

Let's chat more about how you can support Special Olympics Michigan: